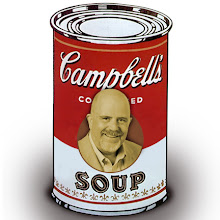

When you see those famous Viking commercials promoting the "What's in your wallet.....," they should add a shot of merchants like me getting pillaged. When I signed on to the service, my rep, a friend from church, didn't explain the difference between the types of cards. From a recent conversation with my service reps on the extra money charged in my monthly statement, it seems that if a client uses one of those cards that provides airline miles or other benefits that I, the service provider/merchant provider, pay an extra fee for those cards.

So, why does VISA and Mastercard make the merchants pay? It's pretty simple. They have everyone by the short hairs, and their sales reps don't explain the difference between the type of credit cards. Truthfully, the credit cards execs know that I wouldn't ask a client for his type of credit card.

So, here's a short primer on credit card terms. There are some cards that take the standard rate, but when you get into Class 2 or 3 credit cards, you get to pay for your client's vacation in Tahiti . If you are smart, you'll ask your bank rep about them the next time your contract comes up for renewal. And, as I have found out, you can also negotiate the cost down on these fees.

However, Visa and Mastercard have nothing on American Express. I got a bill for nearly $6 for processing services even if I didn't use their card. I am in the process of eliminating the Amex cards from my services.

No comments:

Post a Comment